How Does The Buy, Borrow, Die Strategy Work?: In a recent video, I reveal the Buy, Borrow, Die strategy that the ultra-wealthy use to: legally minimise tax; grow their net worth; and build generational wealth. In the video, I show you exactly how this strategy works, and how you can do the same!

If you are an employee, the government is continually taxing you. They do this directly, by raising taxes, but also indirectly.

The government keep tax thresholds the same, while devaluing the currency via inflation. This means over time you will need to be paid more, just to attain the same amount of purchasing power. As your pay goes up in nominal terms, your tax rate also goes up because you hit higher tax bands. This is known as the stealth tax.

On the other hand, the rich make their money from assets. When the value of the assets they own goes up, they make money. They don’t sell the assets, because it would trigger capital gains tax. Instead, they use the buy, borrow, die strategy!

But how does the buy, borrow, die strategy work? In the video, I explain exactly how the rich use this strategy to legally avoid paying tax. If you want to optimise your own tax planning, I highly recommend watching the video until the end. You can watch it at the top of this page or on my YouTube channel.

In this article, I will explain how to use the buy, borrow, die strategy in 3 simple steps. If you are fed up with paying a massive tax bill, while getting very little in return, this blog post is for you! By the end of this article, you will understand what the rich are doing, and can decide if it could work for you too.

I am not a tax professional, and this article and video are not tax advice. This is only a simplified, generalised overview. Before taking any action, speak to a qualified specialist.

I want ordinary people to understand what the rich are doing, so they can do it too. That’s why I wrote this article explaining the buy, borrow, die strategy! However, I need your help getting it out to the public!

Please would you consider sharing this article on social media? Together, we can help everyday people access the same tools the elites use to keep more of their money! Your followers will thank you, and so do I, because sharing makes a big difference!

1. How Does The Buy, Borrow, Die Strategy Work?: Buy Cash Flow Assets, And Wait!

The first step is to buy an asset with cash flow. For example, buying property with a mortgage, and renting it out.

The cash flow from renting the property out pays for the mortgage interest and management costs. Anything above that is profit.

2. How Does The Buy, Borrow, Die Strategy Work?: Borrow Against The Assets When They Go Up In Value!

When their assets rise in value, the rich don’t sell them. They borrow against the new value. Debt isn’t income, so there is no tax to pay! They then use the borrowed money to buy new cash flowing assets.

In the case of property, this means refinancing on to a new mortgage. They then buy another property with the borrowed cash. The rent from the properties will pay the mortgage interest, which is tax-deductible when structured correctly.

3. How Does The Buy, Borrow, Die Strategy Work?: Pass The Assets On To Your Children In A Tax Optimised Way!

The final step is passing the assets on to their family when they die. The rich do this in a way that minimises taxes as much as possible.

The exact steps they take to do this will depend on their specific circumstances, which they discuss with a specialist tax professional.

How Does The Buy, Borrow, Die Strategy Work?: How To Buy The Assets!

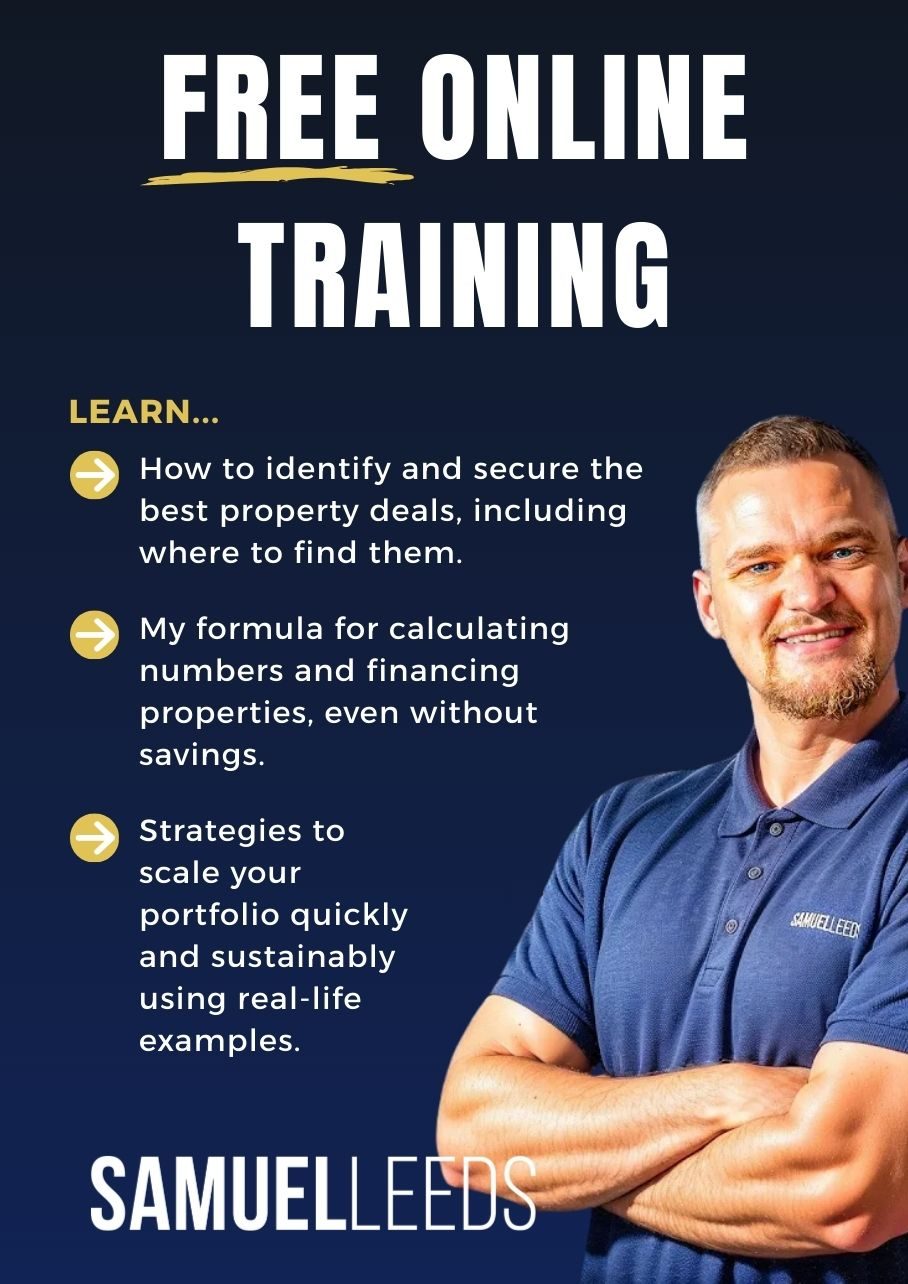

Now that I have answered the question ‘how does the buy, borrow, die strategy work?’, it’s time to learn how to buy the assets in the first place! Join me at my next introductory online training event!

We have different online trainings throughout the year, each teaching different things. Here is a sample of what you could learn on one of our online introductory webinars:

-

The SECRETS to becoming a successful property investor

Get immediate and actionable insights to accelerate your property investment journey.

-

How to LEVERAGE other people's money to get started

Begin to understand the strategies to use to reduce the barriers to getting started.

-

How to FIND fantastic property opportunities

Understand where property professionals source the best deals.

-

How to RECYCLE your money again and again

Don't just do it once, repeat the process to build your property portfolio.

Property investing is not just for the rich! Learn the strategies that thousands of people have used to not only start investing, but become financially free! Tickets are free, so book your property training webinar now. If you are ready to take action, I hope to see you very soon!