Samuel Leeds inspires rugby stars to become successful in property….

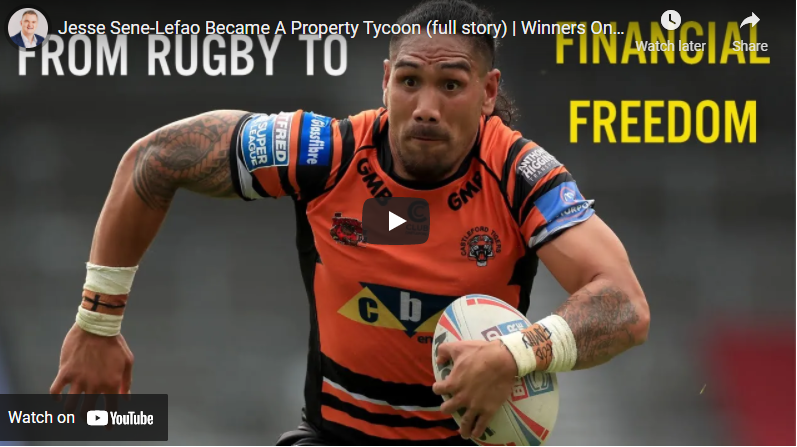

Top professional rugby league players Jesse Sene-Lefao and Quentin Laulu-Togagae are used to triumphing on the pitch. But it might come as a surprise to their fans that they are also winning off the field as entrepreneurs. The pair attended a Property Investors Crash Course after deciding to ‘try’ their hand at making money in the housing market. Two years later, they are running a thriving business renting out 19 furnished apartments and houses in West Yorkshire and the Greater Manchester area for short stays.

‘We need an income after rugby’

Castleford Tigers star Jesse and his former team-mate Quentin, who now plays for Keighley Cougars, love the game of rugby. They are both Samoa internationals and have enjoyed considerable success at club level.

Q, as Quentin is known, once faced the mighty All Blacks and has scored 230 tries in his career, while Jesse is a powerful force in the Super League. The back-rower helped Castleford win the 2017 League Leaders’ Shield and also represented his country in a memorable test match victory over Pacific Island rivals Fiji.

They revel in the excitement of playing in front of crowds of thousands (pandemic excepting) and the rough and tumble of the sport. And yet they know only too well that their time in the limelight is limited.

Fullback Q turns 37 this year and says he needs to look to his future to be able to continue providing for his family.

“I’ve just signed a two-year contract, but rugby is not a long career. You play for 10 to 15 years. So, you’ve got to try to find something on the side once rugby has finished to fall back on.

“Property was one venture that we thought could secure us the financial freedom that we want to get to, especially after rugby.”

Jesse is five years younger, but his motivation is the same.

“The thing that pushed me the most was thinking after rugby what am I going to do. I don’t want to work in a factory. I don’t want to be told what to do. I’d rather have something that’s going to give me a passive income.”

It was Jesse who first came across Samuel Leeds’ free online property education content and saw how he was helping to make people financially independent. When the sportsman found out that Samuel was about to hold a crash course in Birmingham, and that he also shared his belief in Jesus, he was keen to enrol.

Jesse asked his team-mates and friends if any of them wanted to come along with him. Only Q showed any interest. So, he sent him links to the content, including one of Samuel’s popular Winners on a Wednesday videos featuring successful students.

“I said to Q if we do this, we’re going to become one of those students on Winners on a Wednesday! That’s how it started – just out of sharing a conversation,” Jesse recalls.

His prediction came true recently when Property Investors’ founder interviewed the players for the series on his YouTube channel.

Q was hooked by the videos too and they both went to the crash course, encouraged by Jesse’s optimism and energy to make a go of property investing.

The two men work well together. Jesse is a full-time rugby player who trains in the day, while Q is now part-time and does all his training at night. This means they can take over from each other whenever any work needs to be done on the property front.

They are partners in a company called Try-Line Property Limited which offers high-end serviced accommodation in and around Leeds, Wigan and Wakefield. This includes The Cube, an apartment block of 12 one and two-bedroom flats in Pontefract and a new luxury house in Horbury.

The name of the business reflects the fact that it’s their goal to score a try in rugby and also to get deals over the line in property.

Cheap buy-to-let provides passive income

Jesse’s first move after coming to the crash course was to purchase a buy-to-let. Having learnt how to calculate return on investment, he found a house which would give him a yield of 36 per cent. Remembering that Samuel had said he never touched any potential investment with an ROI under 20 per cent, Jesse realised it was a good buy and went ahead with it.

As his wife wasn’t there at the time, he bought it without her permission, much to her astonishment when he rang her to let her know, he laughs. But it proved to be a wise decision.

“The passive income was the big thing for me. I’m getting about £400 a month from it without doing anything. It was a cheap house as well. I just thought wow look at this.”

Then Jesse joined forces with Q to set up Try-line Property. Rather than investing their money in owning properties, they decided to pursue the rent-to-rent strategy. This allows them to pay the landlord of a house or a flat a guaranteed amount every month and then to rent it out on a nightly basis at a higher rate.

The accommodation is advertised on sites like Airbnb and booking.com to people looking for a larger place to stay in than would be possible by booking a hotel room.

Q says the key to success is researching the area and trying to estimate the occupation rate for the month before then deciding whether or not to take on the property. He is very much the ‘numbers man’ in the business, while Jesse is the networker who finds opportunities.

He got their first deal by promoting himself on his Instagram account as someone looking for property to invest in. As a result, a lettings agency contacted him and offered him a furnished house which would permit serviced accommodation.

“The house was beautiful and in a good location, with a Premier Inn in the local area. I drew a circle of five kilometres around it and the house was in that radius, so I ticked that box. I thought if I can take one room from Premier Inn each night, this would work.”

They took it on and couldn’t stop texting and ringing each other when they saw how many bookings were coming in.

Q believes they complement each other well.

“We bring different aspects to the company. I thought I was out there. This guy’s on the next level of out there. If it wasn’t for him promoting the company, we wouldn’t get people interested in us.

“Like with this block of apartments we control. Jesse said we should take 12 and I said I’m not sure we’re ready. But if he hadn’t taken action, we wouldn’t have taken this one on. It’s a good balance that we have, and I think that’s why it’s worked so well.”

The players took on their second rent-to-rent property in Sheffield immediately after the first one. They managed it themselves, even doing the cleaning to find out the ‘good and the bad’ side of the business. However, that one didn’t perform as well, especially when Covid hit.

Jesse blames the dated look of the accommodation, while his partner admits they tried to cut corners with the design. It was a lesson learned and one they have studiously avoided repeating with their other rentals which are furnished and laid out to a high standard.

“We learnt so much from that experience. It was just such a blessing that our Carleton Road house in Pontefract was doing so well it would cover the cost. We got another one in Wakefield and it flowed from there. Now all of our properties are doing really well” says Jesse.

In total, they control 20 properties, including the house he bought.

Their wives were unsure early on about their spouses’ property activities, he adds, joking that they both almost got divorced because of it. That was one reason why they opted for the rent-to-rent strategy.

“We were willing to invest our money to try to make this work and they didn’t agree because it was out of the ordinary for us.”

Jesse agrees: “No one in our circle was doing that, but for you to get extraordinary results you need to step out and take action.”

“I wanted to prove as well that you can do this with no money,” Q explains.

“We had to put money in for our first deal but now we haven’t had to put any money in because we’re constantly putting it back into the business.”

They also attracting investors on the back of their success which is helping them as they seek to expand their portfolio.

Their wives too are on board these days which has led to a reversal of their roles.

“They’re bossing us around now!” says Q. “They are on the payroll and have a big say in which properties we take. They do the viewings and will say whether something works or not.”

They all take salaries as employees of the company and their income fluctuates from month to month, which makes it hard to give a figure for what their actual profit is. However, Q says their business goal is to try to add another five properties to their portfolio by the end of the year.

“Then we would be able to stop playing if we wanted to, although we’d never choose to do that because we love rugby.”

Jesse wants to set their target even higher at 40 properties because they are already approaching their initial goal.

Their families are hugely important to both of them.

“Providing for our families is our biggest reason for going into property but also having time to spend with them,” says Q whose wife is about to give birth to their third child. “I don’t want to spend nine to five in a factory job and not be able to take my kids to school or pick them up.”

Father-of-four Jesse echoes this sentiment, adding: “Our families have always worked for someone. They’ve never owned a business or been in property. If you look at all successful people around you in the world, they own real estate.”

Jesse and Q’s tips

- Q: If you don’t work and learn all the time to be successful you won’t get the results. We viewed about 50 properties before we got our first yes. That’s all part of the process and learning – the groundwork. We started reading loads of books. We put a lot of energy and effort into learning about property and just making sure we had as much knowledge as possible.

- We networked and met people who were willing to help us out for our journey. You won’t come across many successful people who have become successful by themselves. There are always people to help you and it was the same for us.

- Never let anyone tell you that you can’t do it. Put your mind to it and be willing to put in the hard work you need to become successful. You’re always going to face setbacks. It’s what you do after those setbacks that counts.

- J: If you see something you like and enjoy, go straight to the person who’s doing it and living it to get advice. I’ve benefited so much from being able to ask Samuel questions.

Samuel Leeds’ verdict

“A lot of people might think it’s easy for Jesse and Q. They’ve got a good career in sport and can just dump their money in property. They started off that way but said let’s push the boundaries and do rent-to-rents. The fact they’re now bringing in investors is amazing.

“It’s a great honour for me to work with professional sports people and to help them prepare for life after they retire by teaching them about property. Hopefully, what Jesse and Q have done will inspire other rugby players to follow suit.”

Share this video: https://youtu.be/p3c0G2nEVFA

🎥 How to build a property portfolio from scratch in 7 DAYS: https://youtu.be/RWEkj1y8XKs

📖 My favourite book: https://amzn.to/39VcYLa

❓ Have a question about property? Join my Property Facebook Group: https://www.facebook.com/groups/77861…

🗣️FOLLOW ME ON SOCIAL MEDIA:

Instagram: https://www.instagram.com/samuelleeds…

Facebook Group: https://www.facebook.com/groups/77861…

Facebook Page: https://www.facebook.com/OfficialSamu…

Twitter: https://twitter.com/samuel_leeds

LinkedIn: https://www.linkedin.com/in/samuel-le…